After going through previously the nightmare of PCI-DSS Certificates, as described with considerable detail in our writeup previously, we are now faced with a new phenomenon called the Internal Audit Signoff, which is further confusing our clients.

OK, first of all, let’s do a brief recap.

How are 3 ways that PCI-DSS can be validated?

Answer :

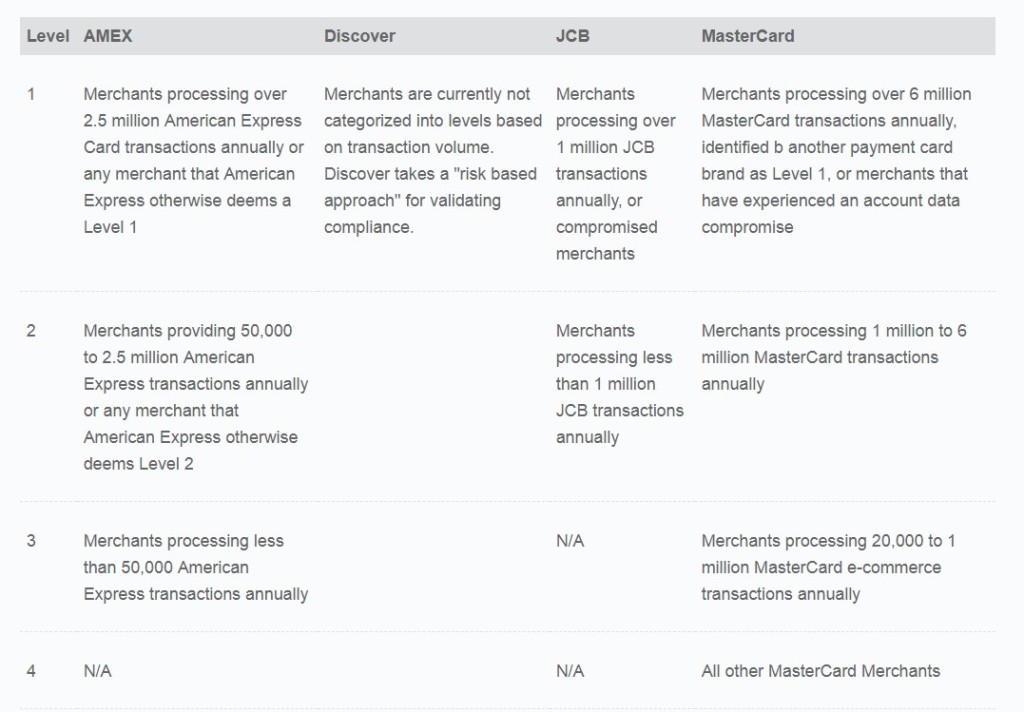

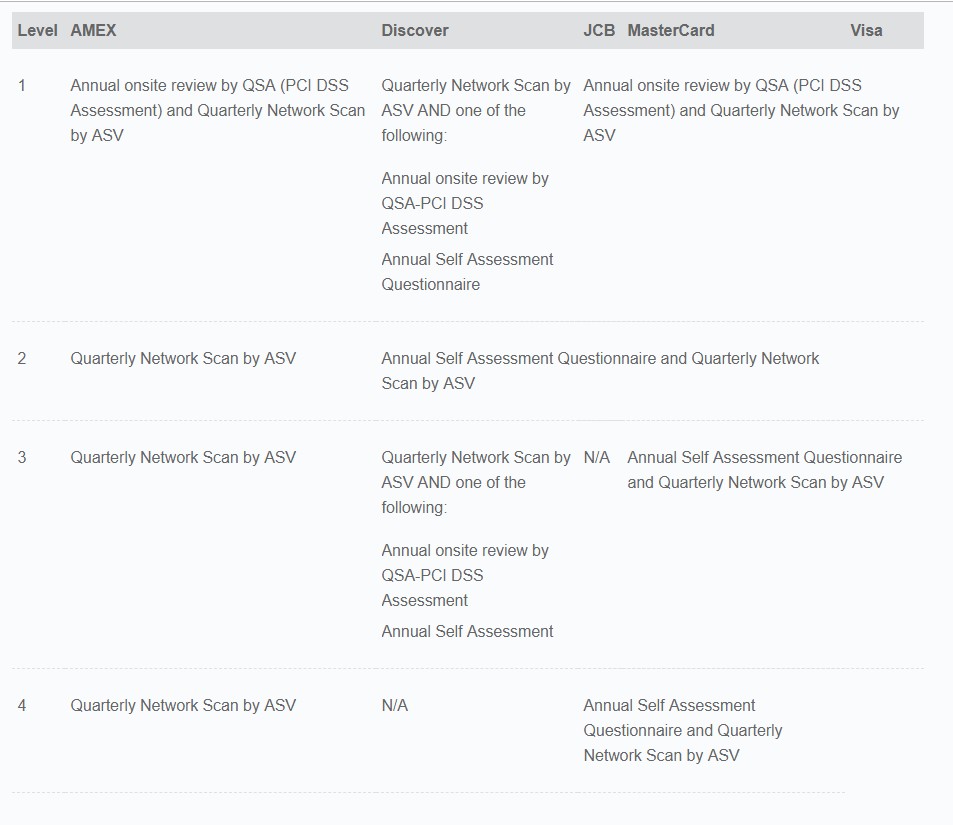

- Full Report of Compliance (RoC) from QSA – Level 1 Service Providers, Level 1 Merchants

- Self Assessment Questionnaire (SAQ) signed off by QSA/ISA – Level 2 Merchants, (Maybe) Level 2 Service Providers

- Self Assessment Questionnaire (SAQ) signed off only by Merchant/Service provider – Level 3,4 Merchant, (Maybe) Level 2 Service providers

Those are the 3 endgames for PCI. And of course, the end scenario called Failure, or non-Compliance. But that isn’t cool, unless you are the type who is happy with Thanos snapping his fingers being the definite end to all things.

Now we all know item 1) requires the participation of a third party QSA/ISA to signoff on the Report of Compliance and the Attestation of Compliance. ISA here is internal security auditor. We won’t touch it this round, because this requires a whole new library of articles to discuss.

Item 2) likewise requires a third party QSA/ISA to signoff on the Self Assessment Questionnaire and the Attestation of Compliance.

Item 3) is basically, self signed – not a lot of acquirers take this seriously as basically, its anyone signing off anything they feel like. There is no validation, and sometimes, it’s akin to the CxO sticking a finger to the tongue and putting it up in the air and going, “Yeah, that feels ’bout right. Let’s sign off and say we have these controls!”

Let’s talk about item 1 and item 2.

In item 1, it’s a gimme that the QSA needs to go onsite to the locations to do an audit. I have never heard of any QSA signing off on a full RoC without actually going onsite. Maybe when our tech reaches a point where the QSA can be holographically present in a location and see what’s there without being physically there like a Jedi Force Ghost, that the PCI-SSC would accept the signoff. But by then, we could probably just tell PCI-SSC that these aren’t the companies they are looking for, and then there’s no need to do PCI.

Until then – the question is for item 2, for the QSA to signoff the SAQ, must they be onsite or they can provide a remote signoff?

Now if you ask a QSA what is the difference between 1) and 2), they would say, not much – except they don’t have to waste their time writing the tome called the Report of Compliance (ROC) for level 2. Level 2 is basically a judgement made by the QSA based on existing

However, for QSAs to conduct their audit and provide a fair opinion on the controls, they will still want to be onsite for option 2), much to the chagrin of many of my customers. Their argument here is: “Hey I am level 2, why must you come onsite??” And again, the crescendo grows that a Level 2 should have

To get to the bottom of this, we got directly from the horse’s mouth (in this case from Mastercard SDP program response: “In this scenario (describing item 2) the QSA has to be onsite. The QSA cannot simply review

To be fair, the above discussion was applied to L2 Merchants (Level 2 Merchants) – those making more than 1 million volume card transactions per annum. Whether the QSA is willing to take the risk and perform an offsite review for a Level 3 or level 4, I wouldn’t know – that’s up to the QSA and the card brands I suppose. But to be absolutely safe, we would

So, as an illustration, we had a request from a company, requesting us, for their location, to get the QSA to signoff remotely. Because “The Other QSA did it for us and certified us”. The other QSA meaning someone they engaged earlier.

OK – this certification term again. I am sure that did not happen – but many use the word certification for anything: actual RoC, doing the SAQ with QSA, signoff on SAQ by themselves, getting ASV scan etc…those are typical scenarios we see this certification word being thrown.

Digging further, we received a worksheet which was a typical ‘Scope’ document (you know, where they ask what sort of merchant you are, what business, how many locations, devices, whether you store card etc), and the instruction was to fill this up, send it over to the QSA and the QSA will ‘sign off’ their PCI-DSS compliance, all within 2 weeks.

QSA certified within 2 weeks, remotely, and with just the scope document, without validating any controls? No penetration testing or ASV? No Risk assessment? No review of information security policy? How?

We asked for the copy of the official signoff page (Section 3c of the AoC) but

I am 100% sure the QSA meant well by this, but the problem was, there are interpretation issues. We cannot expect clients to right off the bat understand PCI-DSS and all it’s seemingly malarkey documents – the AoC, the RoC, the 9 different SAQs, the ASV scans, the partridge in the pear tree etc. So when we asked for

So the moral of this story is: Not all QSA-signed off documents are valid documents for PCI-DSS. ASV scans, while valid, doesn’t make you PCI compliant. It’s only a small percentage of what you must do. Internal Audits or scope reviews like the one we saw, even signed off by the QSA, are not valid PCI-DSS documents. They do not make you PCI compliant. As PCI has explicitly stated before, the only valid PCI-SSC documentation

For more clarity on PCI, drop us an email at pcidss@pkfmalaysia.com. We will try to sort any issues you have, and yes, we are the company you are looking for.