So, on March 31st 2022, PCI-DSS v4.0 dropped on us.

The original timeline for v4.0 has already passed a long time back. Back in 2019, there had been talks that v4 would drop in late 2020. Then due to the global pandemic of unknown origins, it was moved to 2021 and now finally, they decide to release it in 2022. We all know PCI SSC loves deadlines. They love the whooshing noise deadlines make as they go by.

First of all, let’s start with another quote from the wisest sage of all generations:

Don’t Panic.

Douglas Adams

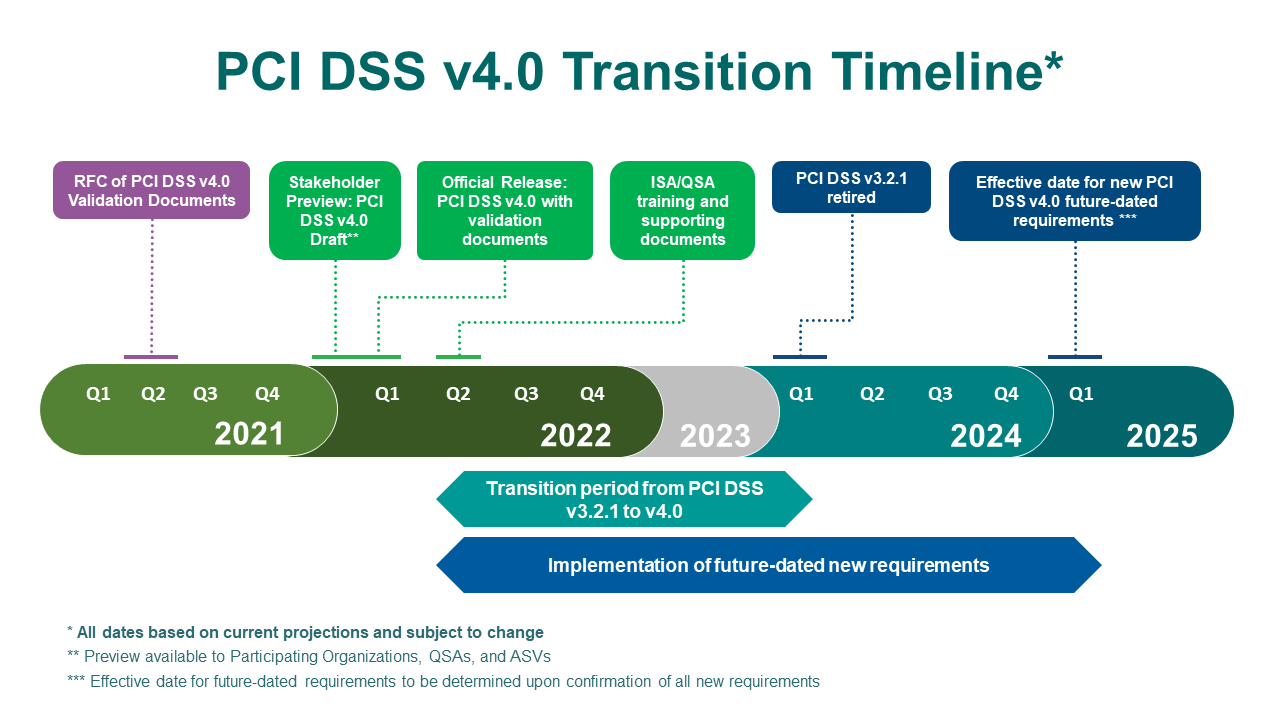

Because if we take a look at the timeline below, there’s a pretty long runway to adopt v4.0.

The above basically means this:

a) Entities undergoing PCI right now, whether it’s first time or renewals, if you are going to be certified in 2022, your current cycle and next renewal in 2023 can stay with v3.2.1.

b) Entities thinking to go through PCI-DSS, and will likely be certified in 2023, you can stay with v3.2.1 for this cycle, and then for the next renewal up in 2024, you will need to move to v4.0

Long story short, entities have 1.5 years to stay on PCIv3.2.1 and go v4.0 on your 2024 cycle. That doesn’t mean that you don’t do anything from now till then of course. Depending on your processes, there may be some changes. However, it’s not too crazy and it’s more incremental than anything else, including areas where we are already practicing , but was not noted in v3.2.1 (example being anti-phishing controls, which have been a staple for most of our FSI clients).

So we’re going to have a few breakdown of areas we think is fairly relevant to note in v4.0; a deeper dive into requirements that are added or changed, and more importantly how we think a company can move forward in preparation.

Of course that being said, the v4.0 is only 3 weeks old. A toddler in terms of its predecessors. Let’s put it into perspective. PCIv1 (and its sub versions 1.1 and 1.2) lasted almost 6 years from 2004 – 2010.

PCIv2 lasted half that time from 2010 – 2013.

PCIv3 and its sub-versions (3.1, 3.2, 3.2.1) lasted from 2013 to 2022. That’s 9 years old. So in retrospect, we are literally in the 0.6% timeline for v4 if it were to follow the v3 age. Meaning, there could be a lot of changes yet to come, or clarifications or explanations etc.

Over the life of v3, we’ve seen many supplementary documents (for scoping, logging, penetration testing, risk management etc) churned out in support to clarify v3 items. While not part of the standard itself, these supplementary documents and hundreds of FAQs are generally quoted or referenced by us to support our arguments for and against some of the decisions that QSAs put to our clients. These are extremely useful especially when QSAs put in some pretty daft interpretations of the requirements (see our previous post on CDD).

There has been some extremely subtle changes aside from the major ones and we want to note these items in page 4 of v4:

PCI DSS is intended for all entities that store, process, or transmit cardholder data (CHD) and/or sensitive authentication data (SAD) or could impact the security of the cardholder data environment (CDE).

Some PCI DSS requirements may also apply to entities with environments that do not store, process, or transmit account data – for example, entities that outsource payment operations or management of their CDE.

In accordance with those organizations that manage compliance programs (such as payment brands and acquirers); entities should contact the organizations of interest for more details.

pci v4.0 warning to those entities that scream i am out of scope because i don’t store, transmit or process stuff!

There’s a lot of things we dislike about v4.0. But there’s a lot of things we LIKE about it as well. So it’s like that family trip that you are taking with your entire extended family. There’s that cousin that you completely dislike that you wish you don’t need to make small conversations with – you know, the one that constantly name drops and questions whether you have achieve as much as he has in life. And tries to coach you to be a better person and live a better life, and have more than your currently unfulfilling, loveless marriage and a deadend, purposeless job as a PCI-DSS consultant. Yeah, you know it. But at the same time, you like these trips because it’s time with your family as well, and time to goof off with your kids, walk on the beach with your spouse and basically fantasize throwing your cousin into a pit full of vipers. v4.0 is like that trip.

The main takeaways from the above quote would be

a) No more free passes to those entities who claim they are out of scope simply because they don’t store, process or transmit card data. If you have impact on the security of the CDE, then you are in.

b) First time we are seeing the word “Organizations of Interest”. While this is nothing much, it’s like watching a movie in the cinema that’s based on a comic book and you see an obscure easter egg referencing to that comic and you get goosebumps because you know, you’re a nerd. And you like this kind of subtle references that no one else knows about. Basically OIs are the upstream customers, banks, FSI, organisations that are requesting your PCI-DSS compliance. It’s easier now to make this reference as it is now an official term in v4.0. Yay.

c) Organizations that ‘impact security’ is in. Previously the problem is that we had outsourced SOC/NOC, or outsourced providers that do not handle card data (e.g managed providers for firewalls etc) and even cloud services that handle the MFA or authentication generation, claiming that there is no card data, therefore they don’t need PCI. That’s fair enough, but we still need to assess that service as part of an on-demand assessment to ensure that that service is properly secured or at least has basic security functionality over it. While a majority of providers are fine with this, we have had antagonistic providers shouting to high heaven that we are idiots because of the very fact that they do not store, process or transmit card data; they should be completely disregarded from the PCI assessment. Um. No. You’re not and V4.0 is smacking you in the face for this.

Another item on v4.0 is the sheer amount of information they provide right at the beginning of the standard. They are talking about the scoping methods, segmentation, encryption and applicability on third party providers, use of third party providers and how to be compliant with them, BAU best practices, sampling methods, definition of timeframes, definition of words like significant changes, approaches to implementation of PCI-DSS, testing methods, assessment process, RoC writing and if you look carefully, there is also a recipe in there for Jamie Oliver’s Yorkshire Pudding.

In the previous v3.2.1, the requirements started on page 20. In v4.0 the requirements start on page 43. The total number of pages in v4.0 is 360, up 158% from the previous 139 pages. So, simply put, you are going from reading Enid Blyton’s Famous Five Goes to Finniston Farm to Leo Tolstoy’s War and Peace.

The requirements themselves remain as 12, so in essence, despite all the fluff at the beginning, the actual requirements are still intact. There’s quite a fair bit of items to look at, and here we provide a brief overview of it:

a) Customized implementation

So, we have this outcomes-based implementation of PCIv4. This is based on the purpose or the ‘spirit’ of the requirements and may not necessarily use the standards-defined controls to achieve it. So, for instance, the requirement to do quarterly internal scans – the objective is to identify vulnerabilities in a regular interval and to ensure that the organisation addresses this vulnerability. Instead of having an option for on-demand scanning, the organisation may opt to sign up for a continuous analysis and automated scanning that are available in cloud such as Google or AliCloud. So while the controls are different, it addresses the same objective.

It is noted that custom implementation should only be done by organisations with a mature risk management practice in place, as this requires more work for the organisation and the QSA to define tests of these controls.

On how this is implemented or samples of it, I am sure we will be seeing more examples as the standard starts maturing. Remember, v4.0 is still a baby, not even out of the maternity ward yet.

b) Multi-factor and Passwords

Multi factor is now needed for any access into the CDE. So, we call in Multi-Multi Factor – whereby, an MFA is required for remote users to get into the network, and from the non-cde network, to get into the CDE, it requires additional MFA. It would seem fairly straightforward, but companies now have to consider to implement a jump server in the CDE to act as a control aggregator to go to multiple systems in the CDE – or they could just deploy another MFA solution on the network .

Passwords are to be changed to 12 alphanumeric up from 7. There’s still a runway on this as it is only considered standard in 31 March 2025. A lot of things can happen from now till then and a lot of technology can change. We could be facing global climate crisis and end of the world, or world war 3 nuclear warfare, or an asteroid could hit earth, or the Rapture happens, you know, future stuff. But in case none of those things come to past, then yeah, make sure you move your passwords to 12 alphanumeric.

c) Group Accounts

8.2.2 gives a needed reprieve on this kerfuffle of having group accounts. In v3.2.1, this is disallowed, but v4.0 , it is allowed, based on the rule of common sense. Some systems do have group accounts for a purpose, or is unable to provide certain functionality to individual accounts. So while there is now more justifications etc needed, it’s no longer a hard no for group accounts.

d) Targeted risk analysis

Targeted risk analysis can now be done to determine the frequency of certain actions – such as password changes, POI device inspections, non-CDE log reviews, low vulnerabilities remediation, FIM review, frequency of training etc. Now while we want to believe that the PCI-SSC idea on having this is for organizations to change frequencies of controls to be MORE stringent (example to have the password changed every 30 days instead of 90 days), the reality is that most of us would stretch this requirement to make life a lot easier for us. I mean, what’s the point of having flexibility if you can’t make it as flexible (i.e as little work to be done) as possible, right?

e) Card data discovery (CDD)

Card Data Discovery Scans – CDD. There is finally some clarifications on Card Data scans to be done every 12 months and to clarify what we have already covered in our previous post in educating the QSA on how to interpret the particular CDD requirement. So yeah, kudos PCI-SSC for supporting us!

d) Misc – Anti Phishing and Full Disk Encryption

As mentioned previously, we now have references to Anti-Phishing requirements, which should have been there long before, to be honest.

We have clarifications which will have significant impact to some of our clients – the use (or abuse) of the full disk encryption requirement. V4.0 has basically blocked that way out for some of our customers utilising Bitlocker with TPM to get past Requirement 3. This is , to us, a fairly significant item of v4.0 which we will be dedicating a post later on it.

Well, so that’s it for the overview for now. We hope to get more articles out to do deeper dives into v4.0 but like I said, it’s still early days and there would be more clarifications ahead. Hopefully it will be more positive, and the experience of v4.0 will be less like that family outing with the cousin that should be thrown into a pit of vipers.

Contact us at pcidss@pkfmalaysia.com for any queries you have on PCI and we will get back to you immediately.

Leave a Reply