We had an interesting discussion a few weeks back about storage in PCI-DSS. We disagreed with an acquirer’s position in how PCI-DSS views storage and therefore opened a whole can of … interesting debate.

The problem the acquirer had with our position was simple. We have a client who is currently doing a data migration import from another service provider to their document management system. Amongst the terabytes of data were possible scanned copies of credit card information, either in forms or actual card photo-copies themselves. Now, we are talking about terabytes.

Our position was fairly straightforward. Do you need these card data? We asked. No, said our client. We don’t need the card data as we do recon and backoffice operations on other form of identification. Can these information be removed or redacted? Bemused, they said, possibly, but the problem is that there are going to be millions of records to be dealt with.

Well, is there a way we can sanitize the data before it enters into your environment?

Yes, possibly, we need to ask the acquirer to ask their current provider to do it for us.

The provider you are taking business away from?

Yes.

Good luck…

And sure enough, the acquirer responded and asked us, “Shouldn’t PCI-DSS allow the storage of these card information, and how your client is able to deal with it? Why do you insist on us redacting and removing the card information? What then is the purpose of PCI-DSS??”

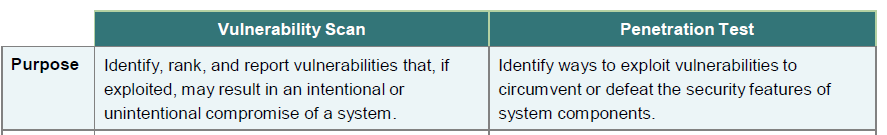

Now, on the surface, that argument does make sense. After all PCI-DSS applies to entities who store, transmit and process credit card information right? Why then wouldn’t we want our client to store credit card information if they are going through PCI-DSS?

Unfortunately, this is a case of getting the solution (PCI-DSS) mixed up with the problem(storing card data). In other words, in a more current analogy, just because I got vaccinated doesn’t mean I would purposely go out and try to get infected so that the vaccine has something to do. The purpose of PCI isn’t for you to store credit card. It’s for you to manage the storage of credit card IF you store it. Storing credit card isn’t a PCI-DSS objective, its an issue that PCI-DSS tries to solve.

So back to this little kerfuffle; if they pass us terabytes of information with card data, our client will need to figure a way to protect this data. Likely encryption of any information that card data is present, which includes key management etc. If they can redact it and remove it before it enters into our client’s environment, then we avoid it. We are basically following the concept of PCI-DSS :

Requirement 3 addresses protection of stored cardholder data. Merchants who do not store any cardholder data automatically provide stronger protection by having eliminated a key target for data thieves. Remember if you don’t need it, don’t store it!

PCI-DSS Prioritized approach

If we don’t need it, don’t store it. In this case, we don’t need it, so we are trying to escape storing it. However, if this cannot be done (which likely it won’t be), then we just need to put controls in there. We’re trying to get our clients to do less and we are also trying to remove card footprints in other areas, thus reducing the risks to the card brands, and likely save the world from impending disaster and destruction.

However, we do have another issue.

Because there is potentially CVV storage (photocopy of cards front and back) and scanned into softcopies, we have a bit of a problem. CVV cannot be stored in any format or in any media post authorisation. So therefore, if this is being dumped into our client’s environment, it’s imperative someone removes this information. To us, its a lot easier to remove it at source; but unfortunately that means there is an effort to be spent on it, which no one is willing to do.

How the CVV got stored in the first place is a question that we don’t have an answer to. However, we do know that if CVV is present, we cannot just encrypt it and be done with it. We will need to remove these information one by one. There are a few solutions out there that can do auto redaction and be applied to a massive amount of files, provided that the files are in a sort of standard fashion. That could be a solution on this, but again, it’s beyond what we are discussing for this article.

The point is, having PCI-DSS doesn’t automatically mean we MUST store card data. It simply means IF we store card data we are applying PCI-DSS controls to that storage of card data.

Let us know if you need more information about PCI-DSS or any IT standard compliance like ISO27001 or CSA/SOC, we are ready to assist, just contact us here. Stay safe everyone!